Worldwide offers generally rose on Thursday, energized by gains on Wall Street drove by a modest bunch of powerful Large Tech organizations.

France’s CAC 40 rose 0.9% in early exchanging to 7,464.15, while Germany’s DAX bounced 1.4% to 18,578.93. England’s FTSE 100 added 0.9% to 8,269.10. U.S. shares were set to float higher with Dow prospects up 0.2% at 40,999.00. S&P 500 fates acquired 0.2% to 5,574.75.

In Asia, Japan’s benchmark Nikkei 225 took off 3.4% to complete at 36,833.27, albeit the additions were mostly an impression of prior sharp drops.

The new less expensive yen was a shelter for certain issues, as it helps the worth of abroad income when changed over into yen. Toyota Engine Corp. hopped 3.8%, while Nintendo Co. rose 1.5%.

In cash exchanging, the U.S. dollar rose to 142.65 Japanese yen from 142.28. The euro cost $1.1022, up from $1.1017.

Shares in Nippon Steel Corp. added 1.8% after Keidanren, a gathering of Japan’s top organizations, communicated in a letter to U.S. Depository Secretary Janet Yellen worries about “political impedance” in Nippon Steel’s proposed obtaining of U.S. Steel Corp. U.S. Steel issues completed almost 7% higher a day sooner.

“America’s venture environment will be seriously discolored on the off chance that such political impedance wins,” as indicated by the letter, which was likewise endorsed by the U.S. Office of Trade, Worldwide Business Partnership, Collusion for Car Development and different gatherings.

Yellen supervises the public authority board of trustees checking on the takeover, while the White House as of late flagged a receptiveness to obstructing the securing.

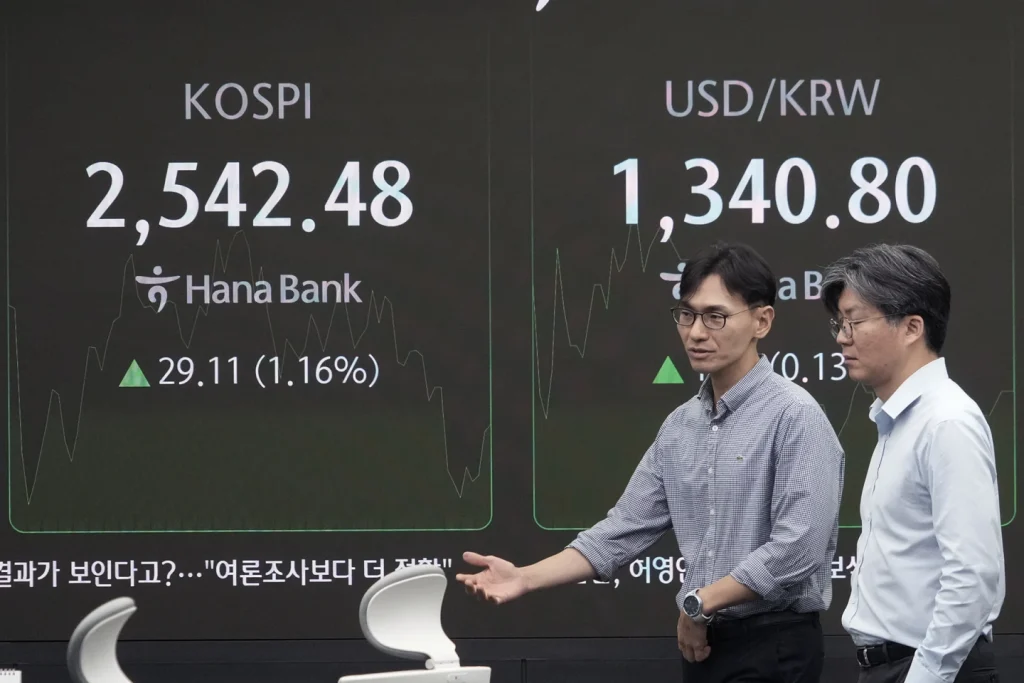

In the remainder of the locale, Australia’s S&P/ASX 200 rose 1.1% to 8,075.70. South Korea’s Kospi rose 2.3% to 2,572.09. Hong Kong’s Hang Seng hopped 0.8% to 17,240.39, while the Shanghai Composite lost 0.2% to 2,717.12.

In the most recent government report on U.S. expansion, by and large expansion eased back to 2.5% in August from 2.9% in July, a touch surprisingly good. Yet, costs rose more than anticipated from July into August while overlooking food and energy, and financial specialists say that can be a superior indicator of where expansion is going.

The information appeared to affirm the U.S. Central bank will probably cut its principal financing cost at its gathering one week from now, which would be the primary such cut in over four years. A concern is that it might demonstrate past the point of no return, with U.S. customers previously striving under the heaviness of exorbitant costs.

In energy exchanging, benchmark U.S. rough acquired 71 pennies to $68.02 a barrel. Brent rough, the worldwide norm, added 69 pennies to $71.30 a barrel.